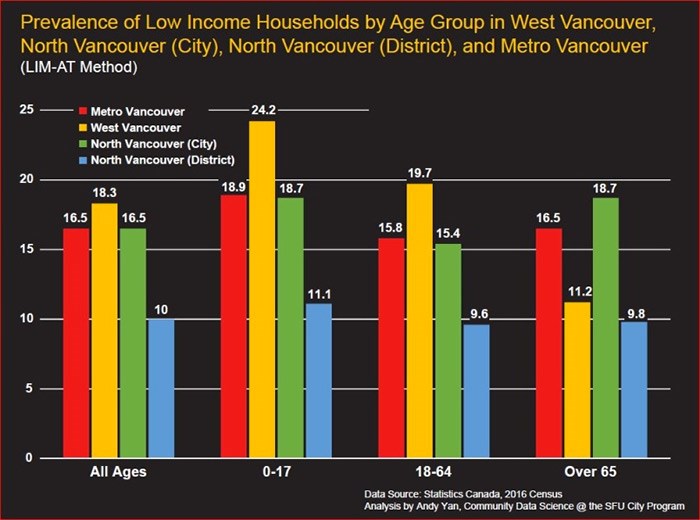

A chart created by Andy Yan shows the relative percentage of low-income households by age group, comparing West Vancouver to neighbouring communities. The analysis uses after-tax low-income thresholds from Statistics Canada. graphic supplied Andy Yan

A chart created by Andy Yan shows the relative percentage of low-income households by age group, comparing West Vancouver to neighbouring communities. The analysis uses after-tax low-income thresholds from Statistics Canada. graphic supplied Andy Yan

The affluent community of West Vancouver, where average home prices hover at $3 million, has one of the highest rates of people with “low income” in Metro Vancouver. At least on paper.

That surprising piece of information comes from an analysis of recently released Statistics Canada income figures by Andy Yan, director of Simon Fraser University’s City Program.

According to Yan’s analysis, there is a higher percentage of “low income” households in West Vancouver – more than 18 per cent – than in Metro Vancouver as a whole, where about 16.5 per cent of households are low income.

In certain areas of West Vancouver – like Chartwell and Ambleside – that percentage of “low income” families climbs even higher, to 25 and 33 per cent of all households.

The number of people living in low income households has also risen dramatically in the last decade in West Vancouver, shooting up by 37 per cent, an increase over double that seen in Metro Vancouver as a whole and about 10 times the rate of change in the neighbouring District of North Vancouver, according to Yan’s analysis.

But are up to a third of households living in mansions worth millions really scraping by on meagre poverty-line incomes?

Yan and other analysts say likely not.

More likely, they say, the figures reflect the limited way that income statistics capture “wealth,” particularly in the case of well-to-do immigrant families whose wealth is often generated outside the country.

“It led to a really interesting discussion,” said Yan, of the numbers he’s come up with.

While rates of poverty are definitely up in suburban areas these days, seeing such high rates of low income in West Vancouver just doesn’t appear accurate in the face of “all that real estate wealth and watching that Lamborghini buzz by you on the Lions Gate Bridge,” he said. “It does not compute.”

Daniel Hiebert, a University of British Columbia geography professor who has studied international migration and its impact on the housing market, said such numbers only make sense in the context that “wealth and income are separate things and we record and tax income, but leave wealth alone in Canada.”

West Vancouver has some similar patterns to Richmond in this regard, says Hiebert, where immigrants rely on wealth from overseas to buy into the local real estate market.

“Does this mean people are poor?” he asks. “No. It means we’re not tracking an essential component of economic well-being: wealth.”

There is also the possibility of undeclared income, whether that is acquired in Canada or abroad, he adds.

For instance, gifts of money among family members don’t have to be declared, he said.

Richard Kurland, an immigration lawyer and policy analyst, said areas like West Vancouver have been on his radar for the combination of low taxes paid despite stratospheric real estate sales. The issue lies in households whose members maintain they are residents of Canada for the purposes of being exempted from foreign buyers’ or capital gains tax in the real estate market yet don’t disclose or pay taxes on the global income which allows them to buy into that market, said Kurland.

“. . . some of Canada’s wealthiest families have all the benefits of being Canadian, but may legally avoid paying Canadian income tax, even though they are living in Canada part time, because they are entitled to be ‘non-residents of Canada’ for income tax purposes,” he said.

Kurland said he’d like to see changes made to the tax system that would see high property taxes levied on millionaire mansions – which could then be lowered for those declaring certain levels of taxable household income.

“It’s a social justice issue,” he said. “Millionaire families enjoy a millionaire lifestyle without contributing a millionaire share of taxes.”

Read more from the North Shore News