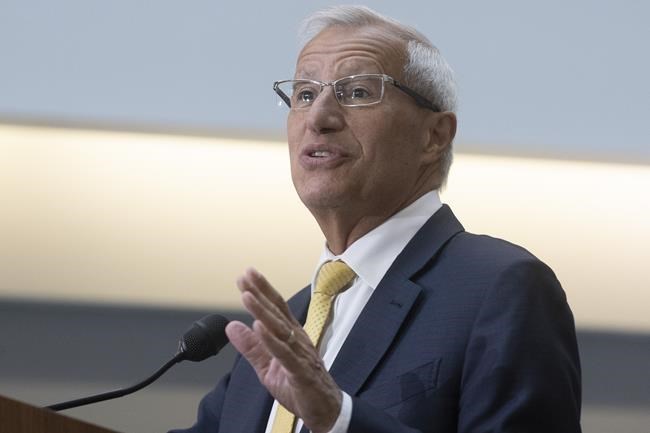

TORONTO — Ontario Economic Development Minister Vic Fedeli calls it the "sleeper story" of the province's massive auto industry transition.

Now that his quest to establish end-to-end electric vehicle production in the province has landed two battery plants, he's setting his sights on lithium hydroxide, a critical component of those batteries.

There are two or three "very good prospects" for bringing a lithium hydroxide facility to the province, with a particular eye on northern Ontario, Fedeli said in an interview.

"We've travelled around the world luring, recruiting these prospects," he said. "(It's) absolutely necessary. You can't make a battery without lithium hydroxide."

Electric vehicles — at the moment — run on lithium ion batteries, made up of a cathode, anode, separator and a liquid electrolyte to allow lithium ions to move between the cathode and anode.

Lithium is one of the key raw materials required for lithium ion batteries — others include nickel, cobalt, manganese and graphite — but it must be processed into the chemical compound lithium hydroxide to be used in those batteries.

After the province announced in March 2022 that automaker Stellantis and South Korean battery-maker LG Energy Solution will build a $5-billion electric vehicle battery plant in Windsor, Ont., interest began to grow in establishing feeder plants here that would supply materials for EV batteries, Fedeli said.

A few months later, Umicore announced a cathode facility in eastern Ontario and this March, Volkswagen announced that it would build an electric vehicle battery plant in St. Thomas, Ont. The province is working to identify more large acreage "mega sites," like the one where Volkswagen will set up.

"The sleeper story will be a lithium hydroxide facility," Fedeli predicts. But it has to happen soon.

"Everybody's looking for a dance partner in the next year. So while the window of opportunity is open right now, it's going to start to close in the next year, because everybody's got to get going (to establish production chains)."

But the hoped-for lithium hydroxide facility — or two — will need sources of lithium.

Quebec mines lithium, and there are other worldwide sources including from Australia and South America, but there are also a few advanced state exploration projects underway in Ontario, said Chris Hodgson, president of the Ontario Mining Association.

"There's a real demand for commodities in the supply chains," he said. "There's two factors: one is geopolitical, and the other is climate change. Both have come together to show the importance of a local supply chain around mining."

Tesla — also rumoured to be eyeing Ontario — "revolutionized" the auto industry by building battery plants close to a supply of materials, Hodgson said.

"They're making big investments in locations close to the supply, and now all car companies are following that," he said.

The geological map of Ontario would suggest there are "huge swaths" of the province that have potential for lithium discoveries, and setting up a lithium hydroxide facility could spur more exploration, said Jeff Killeen, the director of policy and programs for the Prospectors & Developers Association of Canada.

"With increased lithium production capacity within Ontario, it would certainly make the economics more feasible for people to go out and explore and find a deposit that may be economically viable," he said.

"It is a carrot to help incentivize exploration activity."

Ontario already produces cobalt and nickel, two other key minerals for electric vehicle batteries, but there may well be other sources of the materials around the province, the industry says.

But many of the critical minerals needed for electric vehicles may be found in the so-called Ring of Fire, about 500 kilometres northeast of Thunder Bay. Mining activity in that region is and promises to continue being a strong source of tension with First Nations communities in the area.

First Nations throughout Treaty 9 territory, which encompasses much of northern Ontario, recently launched a lawsuit against the province and the federal government, alleging they haven't been properly consulted on decisions involving their land.

Leaders of those communities have visited the legislature several times in recent months to make clear their opposition to road-building for the Ring of Fire and a lack of consultation.

"You're not going to take our sturgeon, you're not going to take our moose," one First Nations member yelled as he was escorted out of the legislative chamber by security last month.

Some of the leaders from the Treaty 9 communities have said they will only meet with Premier Doug Ford, not mining companies. Their lawyer says one of the next steps in the legal challenge will be filing injunctions to stop mining and construction activity on their lands.

Killeen, of the Prospectors & Developers Association, said his organization encourages its members to build early relationships with Indigenous communities.

"Companies need to be conscious of being engaged with the communities they're affecting, or the communities that they're operating around, early and often," he said.

"The regulatory processes are only one piece of the puzzle ... They need to often go beyond that to make sure real, sound agreements and relationships can be established."

This report by The Canadian Press was first published May 11, 2023.

Allison Jones, The Canadian Press