Signing Andrei Kuzmenko out of the KHL was a big deal for the Vancouver Canucks’ new management group. Kuzmenko was a highly sought-after free agent after finishing second in the KHL in scoring last season.

Several factors helped the Canucks get Kuzmenko. They were able to woo him with promises of ice time and a spot on the wing with a high-end playmaking centre in Elias Pettersson. They already had one Russian in Vasily Podkolzin and were about to add another in free agency in Ilya Mikheyev, who helped convince Kuzmenko to sign in Vancouver.

The trouble now is keeping him.

Kuzmenko is a pending UFA

While the Canucks were able to lure Kuzmenko to Vancouver, they were only able to sign him to a one-year, entry-level contract because of his age and status as an undrafted free agent. The upside is that they're getting him at an absolute steal: a cap hit of $950,000, though he will be adding some performance bonuses before the year is up.

The downside is that when his contract expires at the end of this season, Kuzmenko will be an unrestricted free agent, free to sign with whatever team he chooses.

If the Canucks want to keep Kuzmenko, they’ll need to get to the negotiating table before he hits free agency. The Canucks can start negotiating as early as January 1. But what would be fair value for Kuzmenko on his next contract and will that be a contract the Canucks can afford under the salary cap?

The latter question is a tough one that will depend on a number of factors, including how active the Canucks are in the trade market in the coming months.

As for what Kuzmenko’s next contract could look like, that’s a difficult question to answer because he will have a limited track record in the NHL: just one season — or less if the Canucks re-sign him mid-season.

Committing a large chunk of salary cap space on a long-term deal to someone who has yet to prove himself across multiple seasons is risky. Yet, it might be what is necessary to keep Kuzmenko.

How many goals and points will Kuzmenko get this season?

Kuzmenko has proven a quick study when it comes to adapting to the NHL. He’s fit in well on a line with Pettersson and on the first power play unit, but he’s shown that he can still drive play and produce in his limited minutes away from Pettersson and on the second power-play unit.

So far this season, Kuzmenko already has 13 goals and 26 points in his first 28 games. That’s a full-season pace of 38 goals and 76 points in 81 games. He even added his first shootout goal on his very first attempt in the NHL on Wednesday night.

That’s some stunning production from the rookie, though it comes in the context of increased scoring across the NHL. Teams are averaging 3.21 goals per game this season, the highest scoring rate since the 1993-94 season. So, despite his plethora of points, Kuzmenko is only fourth on the Canucks in scoring and is 68th in the NHL.

Kuzmenko is also carrying a very high 24.1% shooting percentage, fourth highest among NHL forwards this season. The odds of Kuzmenko maintaining that shooting percentage over a full season are very low. Just two NHL players have had a shooting percentage of 24.1% or higher over a full season since the year 2000 — Mike Ribeiro in 2007-08 and Sergei Kostitsyn in 2010-11.

Kuzmenko does take a lot of shots with a high likelihood of going in, such as the various tap-in goals he’s had on the power play, but his shooting percentage is still likely to regress over the rest of the season and he’s unlikely to finish the season with 38 goals.

Still, Kuzmenko has a strong chance of reaching 30 goals. It’s also possible that his shooting percentage could regress but he could start taking more shots per game — he has a lethal release that he has only fully demonstrated a few times this season, but could find himself using more as he continues to gain confidence.

It wouldn’t be surprising to see him still finish with around 76 points even if his goalscoring tapers off. His individual points percentage — the percentage of goals scored when he’s on the ice on which he gets a point — is actually a bit below average for a forward, so as his goals go down a bit, he’s likely to pick up a few more assists. Still, it might be safer to assume he falls a bit short and ends up closer to 70 points — still very, very good.

So, to find comparable players for Kuzmenko, I’m looking for 26-year-old wingers with around 30-35 goals and 70-80 points, with a little wiggle room on either side of both of those numbers.

Finding comparable players to Kuzmenko

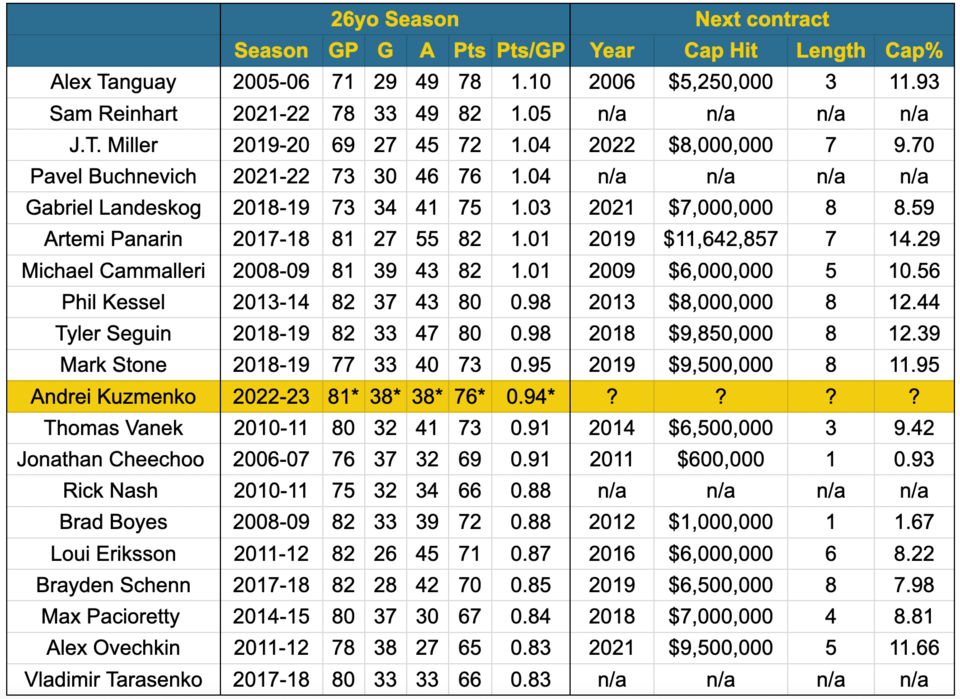

Scouring the list of 26-year-old wingers with similar statistics since the salary cap was introduced results in the following list of 19 players. And what an interesting list it is.

Current Canuck J.T. Miller pops up on this list, as does former Canuck Loui Eriksson. Several of Kuzmenko’s fellow Russians show up, including Alex Ovechkin in one of his lower-scoring years.

If we take this list at face value and look at the next contracts signed by each of these players, we get an average cap hit percentage of 9.37%. The average length of those deals is 5.5 years. 9.37% of $82.5 million — this year’s salary cap — is $7,730,250.

Would the Canucks be comfortable signing Kuzmenko to a five or six-year deal with a cap hit of $7.7 million? That sounds a little bit steep but if Kuzmenko is actually a 30-40 goal scorer with proven chemistry alongside the team’s franchise centre, that cap hit could be considered quite reasonable.

Of course, some of those deals were signed several years after the players’ 26-year-old seasons, so are not an accurate reflection of their value after those seasons. Also, each of those players had a much longer track record in the NHL — years of proof of what kind of player they were and how consistent they were at being that player.

If we look at just the players who signed their next contracts during or immediately after their 26-year-old season, it gets worse, not better. The average cap hit percentage of the five contracts that fit that criterion is 11.85% for an average of 6.4 years. So, that works out to a cap hit of $9,776,250 on a six or seven-year deal.

That, at least, won’t be happening. The Canucks won’t be making their fourth-leading scorer their highest-paid player and it’s unlikely that any other NHL team would make that kind of commitment to Kuzmenko without another season or two to prove he can sustain his scoring pace.

So, let’s take a closer look at these comparable players to Kuzmenko and see if we can come up with something a little bit more reasonable.

Comparing Kuzmenko and Panarin

There is an obvious parallel to be drawn between Kuzmenko and Artemi Panarin.

Both players went undrafted in the NHL and became standout stars in the KHL before signing in the NHL as free agents in their twenties. The year before he came to the NHL, Panarin put up 26 goals and 62 points in 54 games to finish fifth in the KHL in scoring. His 1.15 points per game in the KHL that season is very similar to Kuzmenko’s 1.18 points per game in his last year in the KHL.

Panarin put up 30 goals and 77 points in 80 games in his rookie NHL season, which is not far off from Kuzmenko’s projected point totals, although Panarin finished ninth in NHL scoring with those 77 points — it cannot be said enough how much scoring is up this season. Panarin also benefited from playing with an established star in Patrick Kane, who led the NHL in scoring that season.

As a result, Panarin won the Calder Trophy as rookie of the year, an award that Kuzmenko is not eligible for because he’s 26.

That’s the key difference between the two players — Panarin was 24 in his first NHL season, two years younger than Kuzmenko. Because he was younger, Panarin’s first contract was a two-year entry-level contract that left him as a restricted free agent when his contract ended, not an unrestricted free agent as Kuzmenko will be, so their two situations aren’t directly comparable.

Panarin signed his contract extension after his first year — a two-year bridge deal worth $6 million per year that would take him to unrestricted free agency. He put up similar numbers in his second year with the Chicago Blackhawks, proving that his rookie year wasn’t a fluke, but then was shockingly traded to the Columbus Blue Jackets.

As a 26 year old, Panarin put up 27 goals and 82 points in 81 games — again, not dissimilar from Kuzmenko’s projected totals — then took another step forward at 27, tallying 87 points in 79 games.

After four years of proving himself as a point-per-game or better player in the NHL, Panarin signed a massive seven-year, $81.5 million contract with a cap hit of a little over $11.6 million with the New York Rangers — his first contract since that 26-year-old season.

Panarin’s second contract after his entry-level deal and his first contract after the age of 26 are two massively different contracts, so it’s tough to directly compare Kuzmenko with Panarin.

The Canucks might love to sign Kuzmenko to a show-me deal that is the equivalent of Panarin’s two-year bridge contract, but Kuzmenko has no incentive to take such a deal. Since he’s already a pending UFA, Kuzmenko doesn’t need a bridge contract to take him to unrestricted free agency, so why would he sign a two-year deal when he could potentially get a more lucrative long-term contract?

If the Canucks had more cap flexibility, it might be worth paying Kuzmenko more on a short-term deal, but they don’t. Their only option might be to go long-term.

The red flags of Boyes and Cheechoo

A couple of comparable players that show up for Kuzmenko illustrate the dangers of going long-term.

Brad Boyes and Jonathan Cheechoo both had 30+ goals and around 70 points when they were 26. By the time they signed their next contracts, however, they could only get one-year deals worth $1 million and $600,000, respectively.

Boyes didn’t just have a 33-goal season at 26 — the year before, he scored a whopping 43 goals. He was a bargain at $4 million per year, 7.95% of the salary cap at that time.

After that, however, Boyes fell off a cliff. He scored just 14 goals the next season at age 27, 17 goals at age 28, then just 8 goals at age 29 and was a frequent healthy scratch for the Buffalo Sabres.

It’s worth noting that Boyes went on a shooting percentage bender when he scored 43 goals, converting on a whopping 20.8% of his shots. When he scored 33 goals, his shooting percentage was 15.0%. His career average was 11.7%.

Cheechoo is one of the biggest flash-in-the-pan players in NHL history. In the 2005-06 season, at the age of 25, he won the Rocket Richard Trophy as the NHL’s leading goal scorer with 56 goals, thanks to the playmaking efforts of Joe Thornton.

He scored a decent number of goals the season before and after too, including the 37 goals at age 26 that land him on this comparables list.

He didn’t exactly cash in on that Rocket Richard season. He got term, signing a five-year deal, but it was only worth $3 million per season, 7.69% of the salary cap at the time.

Even that modest contract ended up not being worth it. His scoring declined dramatically, particularly when he was no longer on a line with Thornton. He was eventually traded to the Ottawa Senators as part of a deal for Dany Heatley and only scored five goals in 61 games in Ottawa, leading to the Senators buying out the final year of his contract.

Kuzmenko doesn’t seem as one-dimensional as Boyes or Cheechoo but they raise a couple of red flags. The Canucks can’t afford to get fooled by a player with an unsustainably high shooting percentage and should be wary of a player who is cashing in on chances created by a high-end playmaker.

Both of those descriptions fit Kuzmenko to a certain extent with his high shooting percentage and chemistry with Pettersson.

On the other hand, Boyes and Cheechoo provide an interesting starting point for contract negotiations. After their breakout seasons, Boyes and Cheechoo signed contracts worth a little under 8% of the salary cap, likely because they didn't have a significant track record of goal-scoring prior to those breakout seasons.

Since Kuzmenko similarly doesn’t have a track record, 8% is an interesting figure. 8% of the current salary cap works out to $6.6 million. It would be easy to see the Canucks justifying this as their pitch to Kuzmenko on a mid-term deal — perhaps three or four years.

Then again, Panarin’s bridge deal was 8.22% of the salary cap, signed as a restricted free agent. Is it reasonable to expect Kuzmenko to accept a smaller percentage of the salary cap as an unrestricted free agent?

Well, maybe. Because, again, Panarin was in the top ten in NHL scoring; Kuzmenko won’t be.

Can the Canucks afford Kuzmenko?

If it wasn’t already clear, it should be by now: there is no easy answer to how much Kuzmenko’s next contract will cost.

Looking at comparable players has given us a range from $6.6 million to $9.8 million, which isn’t exactly a narrow window. Where in that window Kuzmenko lands will likely determine whether or not the Canucks can afford to keep him.

With the salary cap only expected to go up by around $1 million, the Canucks won’t be getting as much extra space as they might have hoped. Of course, if they’re not re-signing Bo Horvat, that will leave some cap space open — they definitely can't afford both without clearing a lot of money off the books — but it would also leave a massive hole in the lineup at centre.

There's a certain amount of irony that the contract signed by one of Kuzmenko's comparable players, J.T. Miller, could make it difficult for the Canucks to re-sign Kuzmenko to a new contract.

Based on the players currently signed through next season, and barring any trades, the Canucks will have around $15 million in cap space, though that number could change depending on how much carryover they have in performance bonuses. In addition to Kuzmenko, the Canucks will need to re-sign restricted free agents Ethan Bear and Nils Höglander and potentially unrestricted free agents Luke Schenn and Kyle Burroughs.

That leaves enough room to re-sign Kuzmenko but limited space to make improvements elsewhere on the roster. The question is how much term and cap space can the Canucks commit to a 27-year-old top-six winger when the team’s biggest needs are on defence and, potentially, at centre? What will it take for the Canucks to clear enough cap space to both re-sign Kuzmenko and make the rest of the team better as well?

A lot will depend on how Kuzmenko actually performs over the next few months. The date to watch is March 3, 2023, which is the trade deadline. If Kuzmenko is still on pace for 35-40 goals and 75-80 points, he may well have priced himself out of Vancouver, at which point a trade might be in the Canucks’ best interests.