In an unprecedented display of coordinated assistance, Canada’s six largest banks will begin offering customers more relief options in response to the COVID-19 pandemic. President and CEO of the Canadian Bankers Association Neil Parmenter tweeted links to coordinated press releases from Canada’s six big banks, announcing “a commitment to work with personal and small business banking customers on a case-by-case basis to provide flexible solutions to help them manage through challenges.”

The Commitment

The coronavirus pandemic creates many challenges for Canadian homeowners that include not only battling the illness itself but also pay disruption and childcare disruption due to school closures. It’s an emergency that requires immediate action from financial institutions.

In light of these challenges, Bank of Montreal, CIBC, National Bank of Canada, RBC, Scotiabank, and TD Bank are committing to offer financial assistance to customers facing challenges. Most notably, “This support will include up to a six-month payment deferral for mortgages, and the opportunity for relief on other credit products.” It’s a big move for Canada’s major financial institutions during uncertain times.

Delayed Mortgage Payments Explained

While some lenders already give homeowners the option to press pause on their mortgage payments or personal loans in case of life emergencies, the latest announcement from Canada’s big banks gives even more options to Canadian borrowers. If you’re considering taking advantage of this offer, here’s what you need to know.

1. When You’ll Owe

Typically, deferred mortgage payments are tacked on to the end of your mortgage term, essentially postponing your payments for a later date.

2. Get the Whole Picture

It’s important to speak to your bank about the long-term effects of deferred mortgage payments. In many cases, interest accrued during periods where you defer payments can be added to your principal.

None of the big banks addressed in their joint press release whether payment deferrals would be interest free or not, so don’t make any assumptions. Ask if payment deferrals are interest free and see if you’re able to contribute a one-time lump sum payment at a point in the future when your financial situation returns to normal - this will help minimize any excess interest associated with deferring payments.

3. When to Inquire

If you believe that COVID-19 or its effects could impact your ability to make a payment in the future, reach out to your bank now. It’s important you begin the process before you start missing payments to put yourself in a more manageable situation.

Who Benefits

Offering the ability to delay mortgage payments is a huge announcement that will impact the Canadian economy as a whole during what many are calling a financial crisis. Here are a few of the population segments that financial institutions are helping get through this pandemic from an economic standpoint.

Homeowners

Should homeowners need assistance during these extraordinary times, they’ll be able to contact their bank and defer mortgage payments. This is also true for customers who belong to some Credit Unions, including Vancity who announced they would also offer delayed mortgage payments. This gives more financial flexibility to those facing challenges resulting from the COVID-19 crisis, keeping them in their homes without fear of missing payments or foreclosure.

Business Owners

Delayed mortgage payments give homeowners who also run businesses the opportunity to focus their efforts and resources on their businesses during these challenging times. Keeping businesses open and operating keeps the economy moving and workers employed.

Workers

Workers in the tourism and hospitality industries will be some of the hardest hit by the economic impacts of the coronavirus, and delayed mortgage payments will help them adjust for any loss of work.

What to Expect From the Banks

While they may typically view each other as competitors, the six big banks in Canada are acting as a united front to provide financial relief to Canadians through measures such as offering delayed mortgage payments. More than that though, they’re also working together to help limit the spread of coronavirus.

In accordance to the recommendations of Canada’s public health authorities, the big banks are committed to “taking new coordinated measures to support social distancing to control the spread of COVID-19.” Banks will be limiting operating hours and closing branches that don’t offer critical services. Special care will be given to branches in rural communities where options are limited, and while not all details have been made clear, dramatic moves are being made to limit in-person banking options while also establishing a “reserve” of healthy employees to take care of essential services.

Bank of Montreal is temporarily closing roughly 15% of its branch network in Canada, while CIBC will do the same for over 20% of its network. The Canadian Bankers Association has stated that the banks will also be working together to limit hours, with CIBC reducing its weekday hours from 10:00 AM to 4:00 PM.

What it Means For Canadians

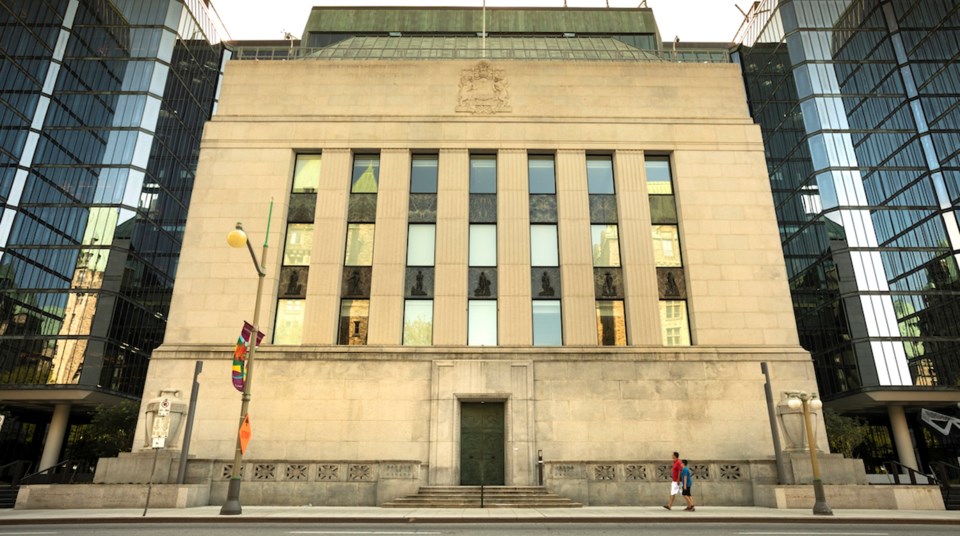

Overall, the ability to delay mortgage payments for up to six months is one of many important economic announcements Canadians have seen as of late. COVID-19 was listed as the main reason for an emergency rate cut from the Bank of Canada on March 4, as concerns over a possible recession and low oil prices loom.

Sellers should see more potential buyers enter Canada’s housing market due to low interest rates, homeowners can consider switching (if possible) into a lower fixed rate or delaying mortgage payments should they run into economic challenges, and despite a delay, changes to the mortgage stress test are coming which should allow first-time buyers to enter the market more easily. We’re expecting more announcements in the coming weeks from financial institutions, policy makers, and the Bank of Canada, subscribe to our newsletter and never miss an update.