The concept of integration is that income earned within a corporation should be somewhat equal to income earned personally, once dividends have been paid out of the corporation. Said another way, integration essentially attempts to make the combined income taxes paid by the corporation and the owner on income earned through the corporation to be equal to the taxes paid on the same income by individuals who do not have a corporation.

The original idea of integration is that there should not be an advantage for earning passive income within a corporation. On June 10, 2024, the finance minister announced the inclusion rate on capital gains realized by corporations will change from one half to two-thirds for all realized capital gains after June 24, 2024.

There was zero grandfathering of previous unrealized capital gains. All incorporated professionals and business owners will be displeased with this announcement.

Over the years of working hard and saving, our clients with corporations have significant unrealized gains that have accumulated — these gains have in some cases taken decades to accumulate. Financial plans have these gains being realized as part of an overall retirement plan. The unrealized gains within corporations can be on real estate, investment portfolios, and other capital items.

The federal government has made it seem like this will only impact a small “wealthy” segment of Canada. That is not likely to be the case.

Let’s use a medical professional as an example. After spending seven plus years studying, working extended hours for many years, they have deservedly been able to save for retirement. Their accountants, lawyers and financial professionals have advised them to save and tax defer with a corporation. The federal government is choosing to pick on those that have already given so much.

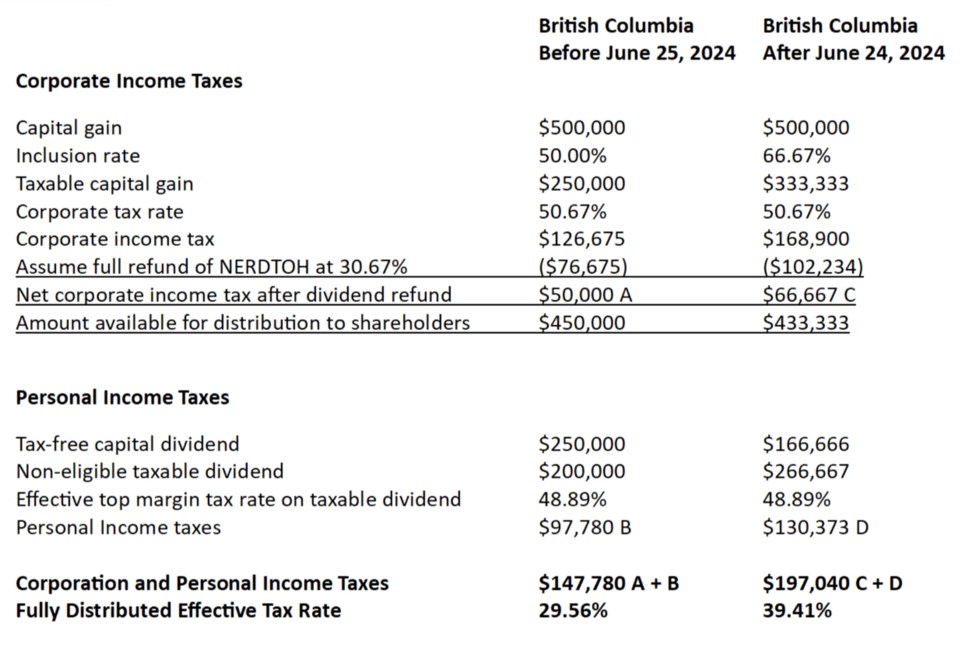

Corporate and personal income — fully distributed

Below we have included an integration table to show how the integration component simply is not working any longer. We will assume $500,000 of capital gains are realized within a corporation both before June 25, 2024 ,and after June 24, 2024.

The recent announcement has effectively increased taxation by 10 per cent within a corporation. Having 10 per cent of your retirement savings wiped away by one government announcement is causing many professional organizations to comment publicly.

Knowing that all future capital gains will also be taxed at this high rate has many questioning if the whole tax system is broken. Will these changes impact the choice of medical and dental professionals, and many other professionals, to work in a country other than Canada? Our clients are growing increasingly tired of the tax increases and question the effectiveness of these tax regulations.

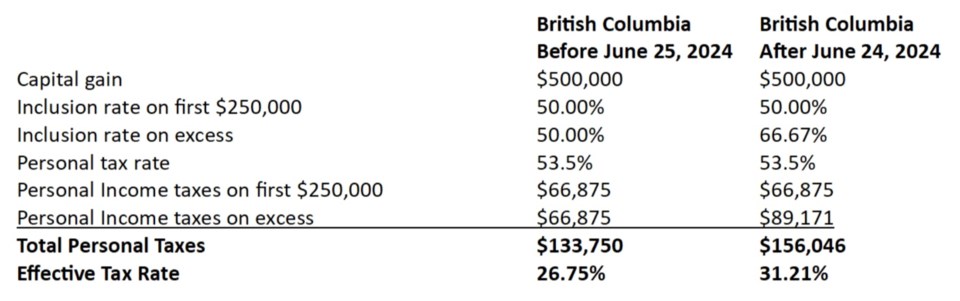

Personal income without corporation — fully distributed

Below is a table that shows what the taxation would be if the $500,000 of capital gains was earned by an individual (not within a corporation) both before June 24, 2024, and after June 24, 2024. We will assume that the individual is in the top marginal tax bracket 53.5 per cent (B.C. + federal combined).

In a typical year, most personal clients (not incorporated) will be able to realize capital gains under $250,000. Dispositions of real estate and deemed dispositions on estates will certainly result in some individuals exceeding $250,000 of capital gains in a single year.

At the top marginal tax bracket, the highest effective tax rate for individuals in these situations is 26.75 per cent if capital gains are kept under $250,000. Couples that jointly own assets can effectively have capital gains up to $500,000 before the higher inclusion rate applies.

Corporations do not have a $250,000 threshold and every dollar is taxed at the higher inclusion rate. The effective comparison for taxable capital gains realized is 39.41 per cent within a corporation versus 26.75 per cent for individuals.

The integration rules that were once carefully planned out are no longer applicable.

Kevin Greenard CPA CA FMA CFP CIM is a Senior Wealth Advisor and Portfolio Manager, Wealth Management with The Greenard Group at Scotia Wealth Management in Victoria. His column appears every week at timescolonist.com. Call 250-389-2138, email [email protected], or visit greenardgroup.com.