Tax season is almost here, and very soon, Canadian taxpayers will focus on ways to reduce their taxes and maximize tax refunds. Generally, you should file taxes if you receive income from an employer, self-employment, investments, or pension source. Also, if you want to claim certain benefits such as child care benefits (CCB), you should plan to file an income tax and benefits return.

When preparing to file your tax refund in 2023, here are key things to note.

Tax return deadlines

Every year, the tax filing deadline is April 30, except if this date falls on a weekend or a public holiday. If you check your calendar, you will see that this date falls on a Sunday in 2023. Automatically, you have until Monday, May 1, 2023 to file your income tax and benefit return.

If you, or your spouse or common-law partner, are self-employed, the tax filing deadline is June 15.

Income tax brackets

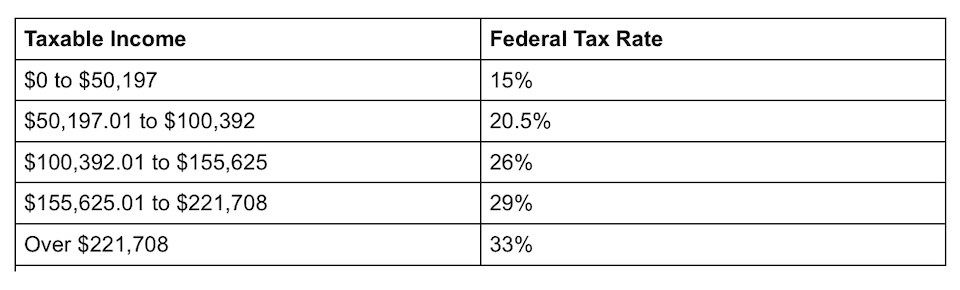

The income tax system in Canada uses marginal rates. The Canada Revenue Agency will tax your income based on progressive levels. The federal tax rates for 2022 are shown below.

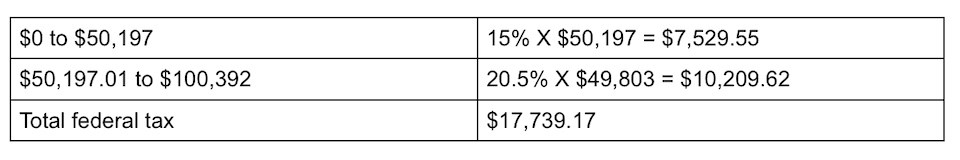

If your taxable income is $100,000, the CRA will calculate your federal taxes as follows:

Your average tax rate = $17,739.17/$100,000

Which is 17.7%.

However, your marginal tax rate is 20.5%.

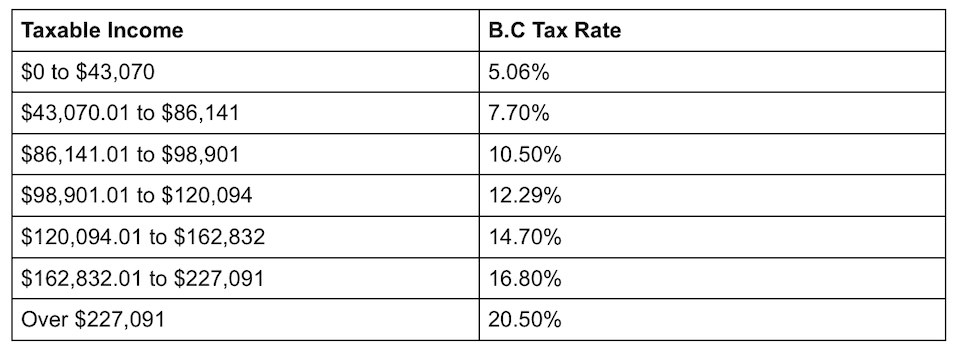

In addition to federal taxes, you will also pay provincial taxes depending on your net income and which province you reside in.

For example, the 2022 income tax brackets for British Columbia tax residents are as follows:

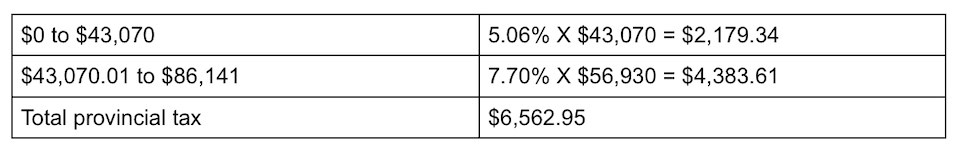

Suppose your taxable income is $100,000, the CRA will apply provincial tax rates as follows:

Tax deductions and credits

You can reduce your taxes by applying various tax deductions and credits that you are eligible to claim. For example, if you contribute to a registered retirement savings plan, also known as an RRSP, you can reduce your taxes with the RRSP deduction. The deadline to contribute to a registered retirement savings plan for 2022 tax deductions is March 1.

Other tax deductions and credits you can claim include:

- Childcare costs to allow you to work, run a business, or attend a school program

- Interest charges for loans you took out to invest in income-earning assets

- Eligible medical expenses that you have not received reimbursements for

- Disability tax credits

- Donations and gifts to charity organizations

- Eligible moving costs to relocate for work or school

Ways to file your taxes

You can file your taxes online, through paper form, or by using a tax representative. You can also use community tax clinics if you have a simple tax situation.

When filing your tax refund online, you can use NETFILE tax software providers approved by the Canada Revenue Agency. Most tax filing software services provide free or paid options. If you file your taxes online, you will receive a tax notice of assessment by email, and you can get your tax refund in as early as two weeks.

Filing your taxes by paper requires you to mail the forms to the CRA, and getting your refund can take up to eight weeks.

Final notes

Start planning for your tax return early to avoid late tax payment penalties. The CRA may not require you to submit supporting tax documents. However, you should keep your tax documents for at least six years from the tax year. The CRA can request them at any time.

If you need clarifications about your tax situation, you can contact the CRA and get help filing your tax refund.