The Metro Vancouver industrial strata market remains resilient despite multiple interest rate increases and economic headwinds, according to Avison Young (Canada) Inc.

The commercial real estate firm provided data to Glacier Media showing seven out of the 10 Metro Vancouver industrial strata markets continue to see year-over-year growth that started in 2020.

These markets refer to industrial space that are bought rather than leased.

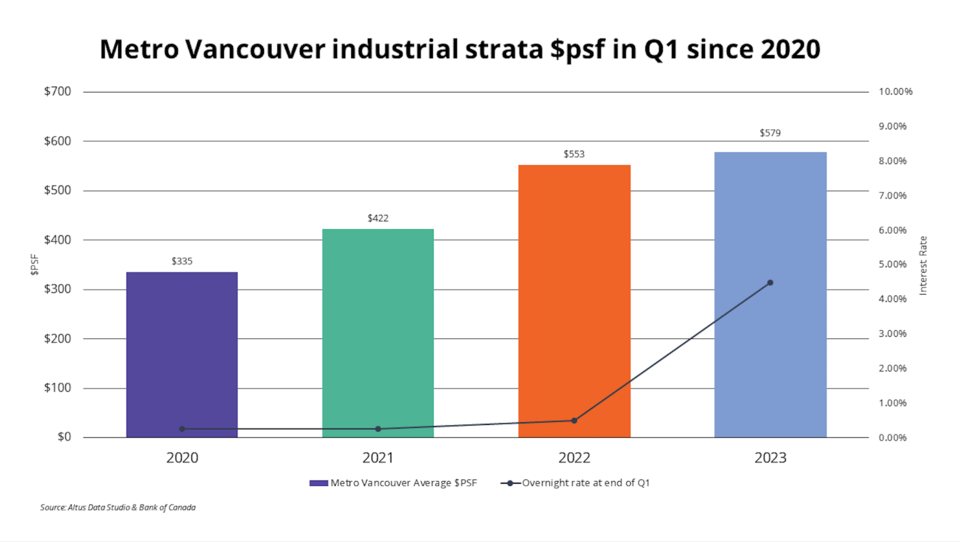

Across the region, prices have increased by roughly 53 per cent from an average of $335 per square foot in 2020 to $579 per square foot in 2023.

Data for Maple Ridge indicates a 23 per cent increase in price per square foot in the first quarter of 2023 compared with the same time last year.

Delta and Langley also saw noticeable jumps in pricing, according to Tim Holloway, Avison Young’s director of innovation and insights.

Prices in Delta increased by roughly 53 per cent from an average of $290 per square foot in 2020 to $501 per square foot in 2023.

During the same period, prices in Langley price increased by roughly 65 per cent from an average of $286 per square foot to $566 per square foot, according to Holloway.

Industrial land prices surged between August 2020 and June 2022 amid ultra-low interest rates and increased demand tied to the industrial sector.

Both contributed to more confidence associated with industrial investments, according to Ryan Kerr, a principal at Avison Young.

“Things did start to slow in terms of demand from June 2022 to January 1, 2023. That was all tied to the rate hikes and the lack of confidence … There's been a huge return to the market since January 1, 2023,” Kerr said.

“Despite the lack of sales activity last summer, and in the fall of 2022, [owners and occupiers] have come back and they're realizing that they need to be here in Metro Vancouver. They're happy to control their cost by owning as opposed to being tenants.”

Kerr is confident that the pricing we are seeing today is here to stay.

Story continues below image

Metro Vancouver’s industrial vacancy rate remains low at 0.6 per cent. The first quarter of 2023 marked the tenth consecutive month that the vacancy rate was below one per cent, according to real estate firm Colliers International Group (TSX:CIGI).

The only markets that have not seen significant growth are Vancouver, Burnaby, Chilliwack and Pitt Meadows.

Vancouver and Burnaby saw the most investor demand from 2020 to 2022, leading to increases in pricing and valuation, Kerr said.

“There's a bit of a cooling of an overheated market that has taken place in early 2023. However, there's active sales at the moment in a number of projects that indicate that pricing is back to where it was before and is actually in the same category as the other seven markets,” he said.

Pitt Meadows and Chilliwack had a lack of price appreciation due to a lack of available strata supply, though Chilliwack will be seeing more available supply in the coming years, Kerr said.