The newly finished expansion of the Trans Mountain pipeline and new LNG projects in B.C. are making for improved conditions for oil and gas producers in Western Canada, Deloitte says its outlook for 2024.

“Despite factors like a mild winter demand and higher-than-average storage levels, the natural gas sector is poised for significant growth, driven by ongoing LNG projects and rising demand for gas-fired electricity generation in Canada,” Andrew Botterill, energy, resources and industrials partner at Deloitte Canada, said in a press release.

“Meanwhile, the oil sector continues to benefit from strategic infrastructure projects like the Trans Mountain Expansion (TMX), which are improving market conditions and supporting production growth.”

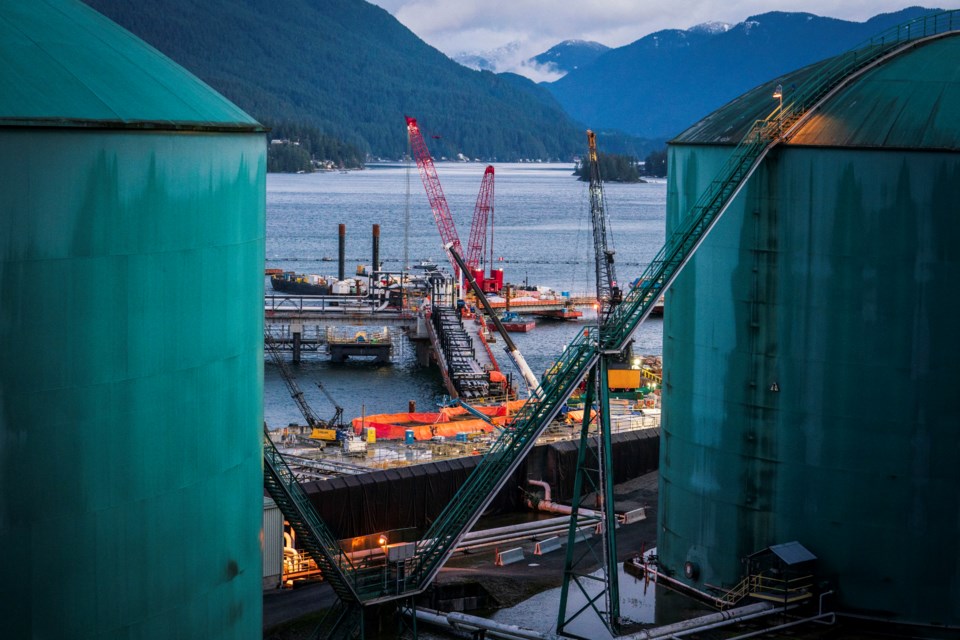

Canada’s first major LNG export terminal, LNG Canada, is expected to begin exporting natural gas next year, and the Woodfibre LNG project in Squamish is in early stages of construction. The partners in the Cedar LNG project in Kitimat just recently announced a final investment decision on the Haisla First Nation-led project.

The new LNG projects may be bolstering natural gas production in B.C. Deloitte’s outlook notes that, while drilling for natural gas across Canada and the U.S. has generally decreased by about 15 per cent, B.C. has seen increased drilling.

“The primary driver for this increase is the need to develop supply for future LNG export capacity, focusing on the prolific Montney Formation,” the outlook states.

“Also, significant progress is being made on LNG projects off the coast of British Columbia. Several projects are on track to be completed by the end of 2030, with a combined potential export capacity of nearly 6.6 (billion cubic feet per day)."

The replacement of coal power with natural gas fired power plants in Alberta is also contributing to increased natural gas demand in Western Canada.

"An additional 2,700 (megawatts) of gas-fired electricity generation capacity is expected to come online in Alberta during 2024," Deloitte's outlook notes. "This development is anticipated to support long-term demand and stabilize prices.”

The report notes that the completion of the Trans Mountain pipeline expansion has improved prices for Alberta crude.

“Canadian oil production is projected to continue growing steadily,” the report forecasts. “The growth is supported by resilient prices for Western Canadian Select (WCS) and Edmonton Light crude, which provide a stable economic environment for producers.

“In the United States, oil production has been flat throughout much of this year so far, with drilling activity levelling off since dropping through 2023,” the outlook notes. “Canadian production has continued to grow steadily as (Western Canadian Select) and Edmonton Light prices have remained resilient through the last quarter.

“Prices have been helped by a weakening Canadian dollar and narrowing differentials to (West Texas Intermediate). With the TransMountain Expansion (TMX) starting up, producers hope narrow differentials are here to stay.

“This development is expected to enhance market access for Canadian crude and support steady production growth.”