The Canadian government has approved a new $20-billion loan to finance the expansion of the Trans Mountain pipeline two years after the government said it would not provide further money for the project.

The loan to the pipeline project, known as TMX, was provided through Export Development Canada’s Canada Account, which supports transactions when the Crown corporation is unable to back a project because of a combination of financial and market risks.

Transactions deemed in the national interest are approved by the Minister for International Trade — or federal cabinet, when loans climb above $50 million or are of a “sensitive nature.”

Quietly listed on an online EDC database Thursday, the refinancing loan was approved Dec. 13, 2024. The latest project plan shows TMX is now in the clean-up phase, with workers reclaiming areas around streams and rivers, planting trees, and back-filling a tunnel at Burnaby Mountain.

An official with the Department of Finance told BIV the latest loan is meant to replace existing higher-cost third-party financing, and will reduce the company’s interest costs so it can pay down construction costs faster as it moves to sell the pipeline. That's expected to reduce financing costs $3.5 billion over six years.

“The government continues to advance its ongoing work to provide eligible Indigenous groups with the opportunity to share in the economic benefits of Trans Mountain,” the official said in an email. “It does not intend to be the long-term owner of the project and will launch a divestment process in due course.”

In 2022, then-finance minister Chrystia Freeland indicated “the government will spend no additional public money on the project.”

Julia Levin, associate director of national climate for Environmental Defence, said that promise has been once again broken.

“This is a very clear violation of the commitment to [former] minister Freeland made,” she said in an interview.

The latest loan brings the total amount of federal financial support given to the oil and gas industry in 2024 to $28.5 billion, according to Levin.

Purchased by the Liberal government in 2018, the cost of the TMX project had ballooned from $7.4 billion to $34.2 billion by November 2024.

That month, Freeland told a parliamentary committee the pipeline was worth its price and “I hope we’re going to sell it for more.”

Four days later, Parliamentary Budget Officer Yves Giroux released an analysis finding that the TMX pipeline could be worth less than what the government paid — between $29.6 billion and $33.4 billion, depending on what happens when the first shipping contracts expire in 20 years.

It's not clear how the latest round of borrowing would affect the PBO's numbers.

Pipeline already benefiting oil sector, says Alberta’s chief economist

Canada has the world’s third-largest reserves of oil. But most of that oil is exported to the United States. The TMX project was designed to expand access to Asia where Canadian crude oil could command a higher price.

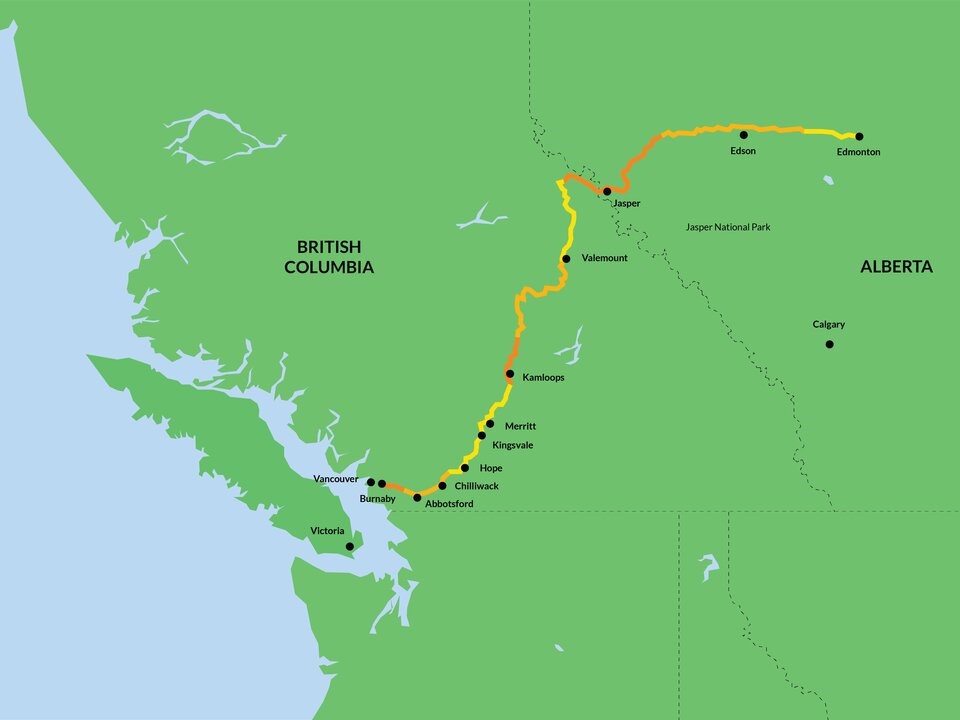

The expansion project twinned an existing pipeline system from Trans Mountain’s Edmonton Terminal to its Westridge Marine Terminal in Burnaby. Operations began on May 1, 2024, with the expansion meant to eventually boost shipping capacity of crude oil to 890,000 barrels from a previous 300,000 barrels.

After six months of operation, the pipeline has already shown significant benefits to the oil sector, according to Alberta’s chief economist Charles St-Arnaud.

In the second half of 2024, non-U.S. oil exports had more than doubled. That reduced the price gap between Western Canada Select and West Texas Intermediate grades of oil, leading to an increase in oil revenues last year by about $10 billion, according to an analysis released by St-Arnaud earlier this month.

The chief economist warned the application of U.S. import tariffs threatened by U.S. President Donald Trump may reverse that trend.

“This means U.S. consumers are unlikely to see the full extent of the tariffs reflected in higher prices at the pump, and that Canadian producers will absorb part of the tariffs,” St-Arnaud wrote.

The impact will lower revenues for oil producers though it will “unlikely” lead to a bust for the oil sector, he said. The Alberta government, in turn, would receive weaker oil and gas royalties that “could push the province into deficit,” said the economist.

St-Arnaud said an export tax on oil revenues instead of an export curtailment to the U.S. could “mitigate some of the impact of retaliation” in a trade war.

Most TMX crude still going to U.S.

Between June and September 2024, the Trans Mountain expansion has been exporting about 600,000 barrels per day, according to data from the Canada Energy Regulator (CER).

When the crude reached the B.C.’s Lower Mainland, about 40 per cent went directly to the U.S. through a pipeline at the Sumas Delivery Point.

The other 60 per cent went through the Westridge Marine Terminal in Burnaby, where it is exported overseas on oil tankers.

Between June and November 2024, half of those ships went to Asia; the other half went to U.S. markets on the West Coast, according to the CER.

Energy regulator spokesperson Amanda Williams said the numbers vary on a month-to-month basis, and that the regulator should have a clearer idea how much crude is being exported where over the coming months.

For Levin, those numbers suggest the promise of the pipeline expansion has fallen flat.

“Most is actually not going to Asia,” she said. “It changes month to month, but consistently, more than half [of TMX’s crude oil] still goes to the United States. So the promised levels of diversification in that sense, never materialized.”

Even if the $50-billion cost of the pipeline is recouped by government, Levin said it doesn’t come close to covering the damage to the global climate system inflicted when the crude oil is shipped and burned overseas over the coming decades.

In 2021, the International Energy Agency recommended for the first time that countries eliminate oil and gas exploration and halt the approval of fossil fuel facilities.

The agency — which had advised countries around the world on their energy policies since its birth in the wake of the 1973 global oil crisis — warned there's enough oil and gas currently being produced and developed to satisfy global demand and still transition fast enough to meet the goals of the Paris agreement.

That agreement seeks to stave off 1.5 degrees Celsius of global temperature rise from pre-industrial levels, the point where scientists say irreversible damage will be done to the Earth’s climate system.

In Canada, Trump’s tariff threats have opened up renewed conversations about building previously scrapped oil and gas pipelines in Canada, such as the Northern Gateway project in B.C.

Proponents say construction of fossil fuel pipelines beyond TMX will further expand access to overseas markets. But for Levin, the pipeline expansion project should not be held up as an answer to looming tariff threats.

“Now we're hearing this call for massive new investments in fossil fuel infrastructure,” said Levin.

“TMX should serve as a warning of the risks to governments and taxpayers that comes with giving in to the industry.”