Many of you, like me, prefer to spend our money on things that we can get behind ethically.

Maybe I can get six gallons of pickles for $2 at Wal-Mart, but I prefer to shop somewhere that doesn't threaten staff when they try to join a union. A Hummer is probably a mighty comfortable ride, but I'd prefer not to drive a living room on wheels that chews through the gas the next six people behind me are trying to conserve.

And gold mine stocks have risen as much as 500% in the first half of this year, but mining... blurgh. It's a bit rough on the old psyche for an aging lefty.

Where you put your investment dollar is as important as where you put your spending dollar. You can get behind big industries that suck but might make you some coin, like oil and military suppliers, or you can get behind industries that will make the world a better place, and maybe earn a little less off the top.

But there is a middle ground, and it's one I've been talking to mining CEOs about at my Equity.Guru site for some time, and that's technology resources.

Sure, to make a Prius battery requires the mining of a whole load of metals that don't exactly leave the places they're dug out of looking pristine. Take the nickel mines of Sudbury Ontario as an example. If you put the word 'moonscape' in Google, it suggests Sudbury as an additional search term.

Nickel has been dug out of Sudbury since 1888, and by the 1960's, the area had 7,000 lakes that had been acidified, with 20,000 hectares of land completely devoid of plant life and 80,000 hectares more in the 'semi-barren' category. In recent years, a lot of that barren land has been reclaimed, but there's a long way to go before you could call it a net environmental gain.

We've had tailings pond collapses in BC. There have been mine collapses and floods covering large areas with mine detritus and rivers and streams in the US filled in with the tops of nearby mountains..

[youtube https://www.youtube.com/watch?v=VYYwzAvQIF8]

Mining is, generally, terrible. But it doesn't have to be. Increasingly, mining companies are using their green commitments as a means of attracting investors and customers, and the end use of the commodities they dig up can sometimes be at the crux of our environmental future.

I'm not talking gold – that's mostly for people to hide their money in. And silver, copper, zinc, they have their reasons for being, in construction and electronics, as an example.

But let's go deeper than the base metals and into what makes rechargeable batteries run. The stuff that powers your laptop and cellphone and tablet and smoke detectors and x-ray machines, and allows us to benefit from solar panels and wind turbines, and allows our electronics to get better, faster, smaller, cheaper.

In a decade, we won't be making cars that burn fossil fuels anymore. We may still have a shit ton of plastics and airplanes and space shuttles that require large amounts of oil to operate, and we'll still have a few clunkers rolling around when the last gas station in Vancouver finally sells to developers, but our cars will be electric. We'll plug them in. They'll be exhaust free and quiet and they'll probably drive us, rather than the other way around.

But what will make them go? Batteries.

[youtube https://www.youtube.com/watch?v=yKORsrlN-2k]

Tesla, right now, is preparing to construct what it calls the Gigafactory, which will provide batteries for Tesla vehicles, but also for home-based 'energy walls' that the company is developing.

Imagine for a second that your home has one wall that is a stonking huge battery, that gathers energy from your rooftop solar panels when the sun is out, and then keeps the home powered up for the next few weeks while the clouds linger. That's the goal – being able to get off the electrical grid, or actually supply it for profit.

The Gigafactory will be the second largest building by usable space in the world when it's completed, and the world's largest building by physical area. It's going to be cranking out batteries like the world has never seen, but Tesla boss Elon Musk says, after he received $800 million of orders for his powerwalls within a week of launching them, he doesn't think the Gigafactory will be able to keep up with demand. He's going to need more battery factories.

Batteries need metals, and metals come from mines, which we don't like. Dilemma!

But maybe not. Commercial lithium comes from brines and clays. It doesn't occur naturally, rather it has to be processed from a mixture of lithium chloride and potassium chloride. Sometimes this is done by simply letting the briny water sit in the sun for a few years and letting it burn off.

You wouldn't want to drink lithium brines, but it wouldn't do you much damage to be around them. We all have lithium in our bodies and it's sometimes used as a treatment for psychological issues. To that end, the process for extracting lithium from brines isn't particularly vile, at least compared to gold, which sometimes requires things like arsenic to process, or nickel, which turns the planet grey.

So lithium isn't destroying communities, it's not blacking out the sun, Terminator style, and since Elon Musk wants a North American supply of the stuff, rather than to ship it from Bolivia or China, that's set off a stampede of local companies who want to be Elon's supplier.

Right now, there's only one lithium mine actually producing the stuff in North America, and that's the Albermarle mine in Nevada.

Earlier this year, a new company formed, named Lithium-X (LIX.V), which grabbed some land surrounding the Albermarle mine and quickly jumped from $0.15 to $2 (We'll talk more about LIX in a bit).

That prompted a tsunami of other companies to emerge, many of them Vancouver-based, all yelling, “We're in lithium too!”, as their stocks jumped 100%-300%.

Most of these companies will never produce lithium. Most will never try to. Most will never even stick a drill in the dirt to see if they have any. Most are based on Howe Street, have two employees (a CEO and a CFO), and run out of offices that also answer the phone in the name of gold companies, copper companies, and weed companies.

They're called 'me too's.' They'll claim some land nearby someone bigger, they'll toss out some news releases that they just 'acquired a new lithium property', hiding the fact that said property cost them about the average wage of a Costco checkout clerk, and was, until yesterday, a dried cow paddock with a rusted out, overturned Chevy.

This wave of lithium enthusiasm drove Vancouver's venture financiers crazy as they fell over themselves to find a dried up lake bed they could sell in early 2016. And investors were right there with them, admitting that it was all crazy and didn't make any sense, but unable to tear themselves away from daily 30% stock jumps.

Until it all stopped, of course, a month ago, when those newer companies failed to ignite and quietly wafted away into the next big trend.

The markets go through these cycles. It happened with weed in 2014, rare earths in 2012, and every single metal there is between 2008 and 2011. Buy while everyone else is buying and hope you're not the one left holding the hot potato when the ass falls out of it all.

But lithium hasn't collapsed, despite its slowdown. In fact, the gap between the industry players and the wannabes has begun to widen, with the real companies beginning to emerge, and the pump-and-dumpers being left behind.

If you're looking to daytrade, lithium probably isn't the thing to follow right now. Like marijuana companies, which had a huge debut, then a huge slump, and then a year long slow rise as the real players sorted themselves out, lithium has just come down the back of that initial hype spike and on a day to day basis, it's all over the place. But long term, as a place to slot a thousand bucks and come back to it in 3 or 4 years, it's an interesting opportunity.

Pick wisely, you could find yourself owning a mining company that's actually helping the green revolution. Profits + ethics + the environment = a good night's sleep.

So, with that, I bring you my weekly top 3 local investment opportunities, the first of which is my pick of the lithium players right now.

THE LITHIUM COMPANY THAT MADE AN INDUSTRY OVERNIGHT

Company: LITHIUM-X

Ticker: LIX.V

[youtube https://www.youtube.com/watch?v=L9ze24xaRdA]

Value: $113.9 million

Share cost (at time of writing): $2.14

Share cost at start of 2016: $0.43

Investor return: 397%

What it does: Lithium-X is a lithium mining company started in part by Vancouver mining billionaire/philanthropist/movie producer/refugee helper Frank Giustra late last year, and it did so well, so quickly, that it turned lithium into a hot craze for most of 2016. Lithium-X was the pioneer, and got good first mover advantage in doing so.

Why I like it: Lithium-X is run by an A-list team of operators who have built billion-dollar mines before, and they have a significant war chest with which to grow fast. That reduces the risk potential of this investment by a lot. Generally with a mining junior, you run the risk that they'll run out of cash, or that their industry will take a downturn, or that they won't raise the money needed to go to full production. Lithium-X faces none of those challenges, but it's still significantly smaller than companies like Albermarle, so there's great potential for growth in a way that could bring fat profits for shareholders.

What's cool about it: In the short term, the company is due to put out a new resource estimate (a calculation of the likely amount of materials underground set to be mined) in the next few days, which is often a catalyst for a big share price bump. If you buy now, you may benefit from that estimate emerging at just the right time.

What's not so cool about it: There are other plays out there that haven't received the big jump Lithium-X has, and which may bring better stock returns as a result. The early LIX investors have made millions in a few months, so while your investment today won't put you in their category, it remains an interesting potential moneymaker as the lithium business plays out.

Any conflicts: None.

THE END OF LIVESTOCK ANTIBIOTICS?

Company: AVIVAGEN INC.

Ticker: VIV.V

[youtube https://www.youtube.com/watch?v=pz-OKp1NqJ0]

Value: $28.5 million

Share cost (at time of writing): $0.17

Share cost at start of 2016: $0.06

Investor return: 183%

What it does: Avivagen is a biotech company that has figured out how to oxidize beta-carotene.

What does that mean? Okay, science time: Beta-carotene is the red-orange stuff you find in a lot of organic plants and fruits that carry a boatload of really great stuff for your insides. Carrots, pumpkins, sweet potatoes, spinach, collards, papayas, mangoes, beets are all rich in the stuff. So, of course, companies have long wanted to break down that beta-carotene so they can use it in animal feed, to make animals healthier and less dependent on antibiotics in food production.

Only problem? It never worked, because the beta-carotene doesn't easily oxidize to make it bio-available inside the animal.

Why I like it: Avivagen figured out how to make the beta-carotene oxidize. Their tech works, has been tested by academics, and , assuming they can get it through regulatory hurdles and get large scale food producers to test and accept the product, it could conceivably remove antibiotics from our food supply entirely, which would be one of the greatest advances in food science in decades.

What's cool about it: This company has been grinding it out for several years, working with large food companies to do small test runs with chickens and pigs, working through the bureaucratic approval processes, they scraped the bottom financially, they held things together through the CEO buying stock when nobody else would, they kept the faith and, this year, everything is finally coming together.

They just got a nice big financing done from some large investors, the share price is moving fast and hard, and it all seems very much like things are leading up to a big news announcement. I've watched Avivagen for several years and this, right now, is their moment.

What's not so cool about it: Honestly, I can't say there's anything about this play that gives me pause for thought. The world wants antibiotics out of the food chain, and many governments have mandated that it happen sooner, rather than later. The industry needs Avivagen, because it doesn't have other options, and Avivagen is duly ramping up.

Any conflicts: None.

SAY HELLO TO YOUR LITTLE FRIENDS

Company: HELLO PAL

Ticker: HP.C

[youtube https://www.youtube.com/watch?v=LGERSwxMWpI]

Value: $28.9 million

Share cost (at time of writing): $0.45

Share cost on listing debut (May 13): $0.23

Investor return: 95%

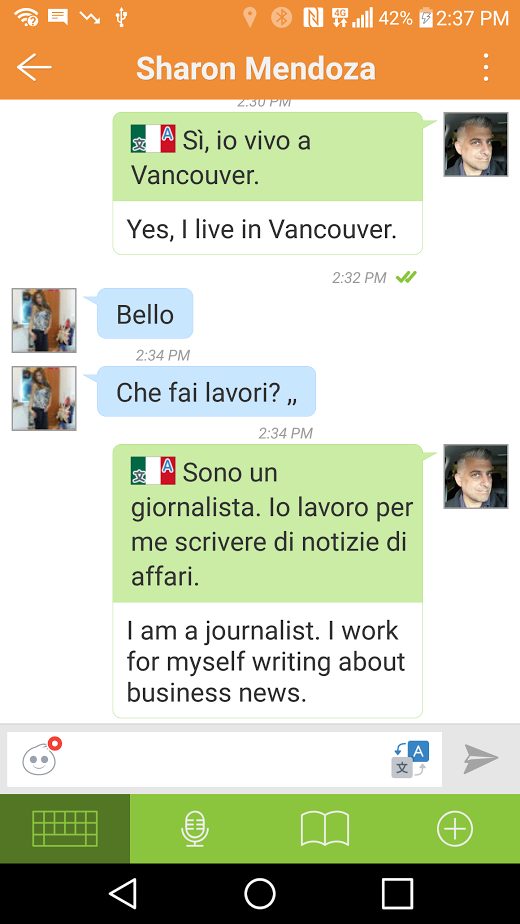

What it does: Hello Pal is a social networking platform that is based around learning new languages by actually speaking to people in other parts of the world using a cellphone app. Think of it as a giant chatroom where you can find people from pretty much anywhere, send them messages, voice calls, or video calls, and use an online phrase translator so that your message in bad English can be converted a message in bad Italian, Spanish, or Hindi, among dozens of others.

Why I like it: I hate app companies as a general rule. Apps are the death of many an investor's bankroll, and require such a huge amount of marketing to get an audience that most just run out of juice before they find their people. Hello Pal has found an audience, and it's truly global. I tried the app out and ended up in a long conversation with a 28 year old Chilean hotel maid living in Firenze, Italy, who was keen to work on her English and happy to help me with some Italian.

To be honest, I was cynical before trying the app, but I can see pretty significant appeal if it can break out into the English speakers like it has in other parts of the world.

What's cool about it: If you were traveling to a country where you knew none of the local language, this app would be amazing as a means not just of meeting local people, but also in communicating once you get there. Also, they have 700,000 users, so the app has already hit that critical mass needed to actually penetrate the greater app market properly.

What's not cool about it: Meh, did I mention I hate apps as an investment opportunity? Unless you're Candy Crushing it, or you're the guy who built Tinder, the gap between start and profitable is a long one. Hello Pal is interesting, on the other hand, because it's been around for over a year, it's costs are low, it just raised $1.8 million, its current growth has been all down to word of mouth, and I keep hearing talk that there's some large Asian tech investors looming that could take this thing stratospheric quickly.

Any conflicts: Hello Pal has paid Vancouver Is Awesome a consideration fee for inclusion in this space.

Finally, I've caught wind of a company that's not yet public but will be soon, that's landing in the US with a novel business proposition that is already making hundreds of millions of Euros in Europe. LottoGopher allows California lottery players to buy their tickets online, check them online, and dodge the often long queues to buy tickets with cash. I'll be writing more about them later, but for now, check out their investor video and, if you're an accredited investor, they're raising money currently.

Contact investor Warwick Smith for details.

[youtube https://www.youtube.com/watch?v=6GeMMnOUwyg]

Thanks for reading, you'll find a lot more information at my Equity.Guru analysis site, and if you're looking for information on how to open a share trading account, we've got you covered.

-- Chris Parry